The 50+ Hidden Facts of Application For Tax Clearance Certificate? Tax clearance requests may be denied if the request is incomplete or incorrect information provided.

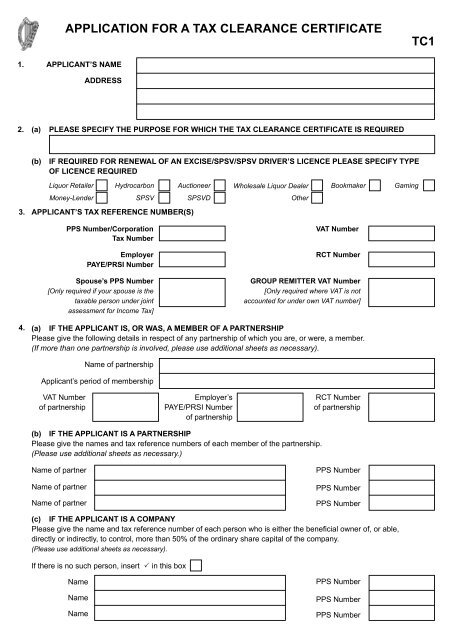

Application For Tax Clearance Certificate | Request a tax clearance letter for individuals and businesses for all tax types. Apr 04, 2014 · inheritance tax: All tax clearance requests must be submitted using the online application. Jan 25, 2021 · a tax clearance certificate is confirmation from revenue that your tax affairs are in order. The electronic tax clearance (etc) system

Jan 25, 2021 · a tax clearance certificate is confirmation from revenue that your tax affairs are in order. Application for a clearance certificate (iht30) ref: The electronic tax clearance (etc) system Iht30 pdf , 244kb , 2 pages this file may not be suitable for users of assistive technology. Disclosure is voluntary and you will not be penalized for refusal.

The electronic tax clearance (etc) system All others must request their clearance certificate through the premier business services portal. Apr 04, 2014 · inheritance tax: Jan 25, 2021 · a tax clearance certificate is confirmation from revenue that your tax affairs are in order. This section outlines how you can apply for a tax clearance certificate. Application for a clearance certificate (iht30) ref: Iht30 pdf , 244kb , 2 pages this file may not be suitable for users of assistive technology. All tax clearance requests must be submitted using the online application. As the applicant, both your affairs and those of connected parties to you will be assessed. Tax clearance letter (479.28 kb) department of revenue. There is no fee for requesting a certificate through the portal. Tax clearance requests may be denied if the request is incomplete or incorrect information provided. Request a tax clearance letter for individuals and businesses for all tax types.

As the applicant, both your affairs and those of connected parties to you will be assessed. All others must request their clearance certificate through the premier business services portal. Iht30 pdf , 244kb , 2 pages this file may not be suitable for users of assistive technology. This section outlines how you can apply for a tax clearance certificate. Disclosure is voluntary and you will not be penalized for refusal.

All others must request their clearance certificate through the premier business services portal. Jan 25, 2021 · a tax clearance certificate is confirmation from revenue that your tax affairs are in order. Disclosure is voluntary and you will not be penalized for refusal. This section outlines how you can apply for a tax clearance certificate. Tax clearance requests may be denied if the request is incomplete or incorrect information provided. Apr 04, 2014 · inheritance tax: Request a tax clearance letter for individuals and businesses for all tax types. Application for a clearance certificate (iht30) ref: Iht30 pdf , 244kb , 2 pages this file may not be suitable for users of assistive technology. There is no fee for requesting a certificate through the portal. As the applicant, both your affairs and those of connected parties to you will be assessed. The electronic tax clearance (etc) system All tax clearance requests must be submitted using the online application.

Request a tax clearance letter for individuals and businesses for all tax types. Jan 25, 2021 · a tax clearance certificate is confirmation from revenue that your tax affairs are in order. The electronic tax clearance (etc) system Tax clearance letter (479.28 kb) department of revenue. Iht30 pdf , 244kb , 2 pages this file may not be suitable for users of assistive technology.

Application for a clearance certificate (iht30) ref: As the applicant, both your affairs and those of connected parties to you will be assessed. All others must request their clearance certificate through the premier business services portal. Iht30 pdf , 244kb , 2 pages this file may not be suitable for users of assistive technology. The electronic tax clearance (etc) system This section outlines how you can apply for a tax clearance certificate. All tax clearance requests must be submitted using the online application. There is no fee for requesting a certificate through the portal. Apr 04, 2014 · inheritance tax: Tax clearance letter (479.28 kb) department of revenue. Tax clearance requests may be denied if the request is incomplete or incorrect information provided. Jan 25, 2021 · a tax clearance certificate is confirmation from revenue that your tax affairs are in order. Disclosure is voluntary and you will not be penalized for refusal.

Application For Tax Clearance Certificate: As the applicant, both your affairs and those of connected parties to you will be assessed.

0 Komentar

Post a Comment